Stop - hang up - call 159

Call 159

159 is a security scheme launched in conjunction with major UK banks. Calling 159 puts you directly in touch with your bank.

If you receive a phone call and you think someone is trying to trick you into handing over money or personal details: STOP, HANG UP & CALL 159.

159 (Stop Scams UK website opens in new tab) will never call you, but you can rely on 159 to get you through to your bank. Call 159 if -

someone contacts you saying they’re from your bank, even if they are not suspicious

you receive a call asking you to transfer money or make a payment, even if it seems genuine

you receive a call about a financial matter and it seems suspicious

Minimising your risk of fraud

A message from Buckinghamshire Council

Fraud protection involves safeguarding oneself against deceptive practices that can lead to financial or personal harm. Taking positive action to block the routes of communication often exploited by criminals is essential. Being aware of potential threats helps you recognise and avoid them.

Secure your accounts: Use strong, unique passwords for each account, enable two-factor authentication, and regularly update your passwords. This adds an extra layer of security to your online accounts.

Monitor financial statements: Review your bank and credit card statements for any unauthorised transactions. Reporting suspicious activity promptly can help mitigate potential damage.

Protect personal information: Be cautious about sharing personal information online or over the phone. Only provide information to reputable sources and avoid oversharing on social media.

Be wary of unsolicited communication: Confirm the identity of individuals or organisations before sharing sensitive information or making transactions.

Say 'No' to doorstep callers: They might claim to offer services, products, or assistance. Politely but firmly decline any offers or requests and avoid sharing any sensitive details or signing any documents without thorough verification.

Criminals are experts at impersonating people, organisations and the police. They spend hours researching you for their scams, hoping you’ll let your guard down for just a moment. Stop and think. It could protect you and your money.

If the worst has happened

If you have been a victim of fraud, report it to Report Fraud (website opens in new tab) or call 0300 123 2040. Reporting fraud helps track down and stop fraudsters and can prevent other people from becoming their victims.

Remember, falling victim to fraud is never your fault. Scammers are skilled at manipulation, and anyone can become a target. It's essential to acknowledge that the experience of fraud, even if prevented, can still trigger feelings of vulnerability, anger, or anxiety. Remember, these emotions are natural reactions, and seeking support from friends, family, or professionals can provide a safe space to process them.

If you have been a victim of fraud, contact Victims First (website opens in new tab) or call 0300 1234 148.

Quishing fraud

A message from Thames Valley Police

Thames Valley Police are urging the public to remain vigilant to fraudulent QR codes which can easily turn from convenience to con.

‘Quishing’ or ‘QR Code Phishing’, involves tricking someone into scanning a QR code which once scanned, will take you to a bogus website where you innocently input your details thinking you are paying for a service or visiting the genuine site, when in fact, you are unknowingly sharing all your personal details with criminals, which could lead to identity fraud.

How to spot a fake QR code

QR codes are often found on things like parking machines, charging points, emails, even restaurant menus.

If the QR code is on a poster in a public area, always check whether it appears to have been stuck over the original. If the sign or notice is laminated and the QR code is under the lamination or part of the original print, chances are it is more likely to be genuine.

If in doubt, download the app from the official Google or Apple store or search the website on your phone’s internet browser, rather than scanning a QR code to take you there. It may take longer, but it is more secure.

Check the preview of the QR code's URL to see if it appears legitimate. Make sure the website uses HTTPS rather than HTTP, does not have obvious misspellings and has a trusted domain.

Use your phone’s built-in QR scanner (available in most Camera apps) rather than downloading third-party QR scanning apps, which can sometimes be risky.

Trust your instincts!

Trust your instincts. If something does not seem right, do not scan, alert the owner of the QR code and police by calling 101 to report.

Quishing can also occur on online shopping platforms, where sellers received a QR code via email to either verify accounts or to receive payment for sold items.

Fraudsters may impersonate banks, or other UK government organisations such as HMRC. If you receive an email with a QR code in it, and you are asked to scan it, you should be cautious due to an increase in these types of 'quishing' attacks.

Get help

Report a suspicious email but forwarding it to report@phishing.gov.uk

Read this Guide to Reporting Fraud (Report Fraud website opens in new tab)

Find out how to protect yourself from fraud (gov.uk website opens in new tab)

Sign up for Thames Valley Alerts (TVP website opens in new tab), a free email messaging system where you can receive regular crime updates, information on ongoing incidents and crime prevention relevant to your local area.

Tackling courier fraud

What is Courier Fraud?

Courier fraud typically involves a criminal posing as a police officer or bank official. They claim there is fraudulent activity on your bank account and ask for sensitive information like your bank details and PIN. They may then instruct you to withdraw cash and will send a courier or taxi to collect the money “to support the investigation” - money you will never see again. To find out more about how this fraud works and how to protect yourself visit the Crimestoppers (website opens in new tab).

What do I do?

If you or someone else is in immediate danger or risk of harm, dial 999 now. Otherwise -

REPORT an incident of courier fraud to Report Fraud (website opens in new tab) or call 0300 123 2040 (Monday to Friday, 8am-8pm).

VISIT the government website Stop! Think Fraud! (opens in new tab) to equip yourself with the knowledge and tools you need to stay ahead of all types of phone scams.

CONTACT VICTIM SUPPORT for free, independent and confidential advice if you are the victim of crime. Call 0808 1689 111 or start a live chat on the Victim Support website (opens in new tab).

FOLLOW the advice at Take Five to Stop Fraud (website opens in new tab).

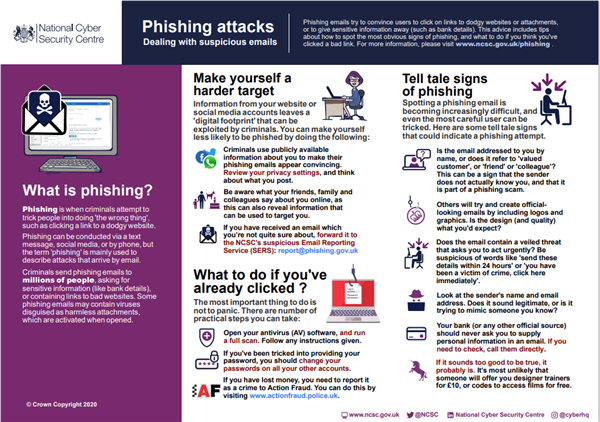

Phishing attacks

Dealing with suspicious emails

Go to the National Cyber Security Centre website (opens in new tab) to learn what to do if you receive - or click on - a suspicious email.

Beware QR Code Scams

QR code scams can take many forms

QR email scams (known as ‘quishing’; a mix of QR codes/email phishing) You may be asked to scan a QR code within an email appearing to be from legitimate company.

QR payment scams Scammers can place QR codes in public places such as parking meters and restaurant menus, covering the original QR to steal your card details/money.

QR donation scams Scammers may attempt to steal money by creating a fake charity or impersonating an existing one.

QR package scams Criminals may send you mail that you never ordered requesting you to scan a QR code on the package for more information.

Help protect yourself by taking the following steps

Take 5 before you scan! Don’t be rushed.

Check for tampering; make sure the QR code isn’t hiding an existing QR code. Contact the company if in doubt.

Ensure the QR website URL seems legitimate. Does it look right? Check for misspelling of the site.

Don’t scan QR codes from unknown senders.

If you think you are a victim of a QR code scam

Contact your bank so they can take steps to protect your finances.

Change your passwords, ideally setting up two-factor authentication.

Report the scam to Report Fraud (website opens in new tab) or call 0300 123 2040

Scam awareness training

A scam is a fraudulent attempt to get money from someone after making uninvited contact by phone, email, letter or in person. Scams are an ever-present risk with even the most seemingly savvy amongst us at danger of being fooled.

Friends Against Scams (website opens in new tab) is a National Trading Standards Scams Team initiative which aims to protect and prevent people from becoming victims of scams. The organisation offers in-person and short online Scam Awareness sessions to increase understanding about the different types of scams, how to report them - and how to support a victim of a scam. People who have completed the training are encouraged to share their knowledge with family and neighbours.

Call blocking

Buckinghamshire and Surrey Trading Standards (website opens in new tab) offers free trueCall call blocking devices to those whose are vulnerable and are susceptible to scam calls. The device plugs into a landline phone socket and automatically blocks unwanted calls. Read more on the Trading Standards website (opens in new tab) or call Bucks & Surrey Trading Standards on 0300 123 2329 to see if you or a family member are eligible for a free trueCall device.

Car parking scams

Extracts from an Alert Message from Thames Valley Police

From Fake Text messages about unpaid tickets to tampered car park machines that secretly steal your card details, fraudsters are becoming increasingly creative.

Fake parking fines

Three signs to ascertain that it is a genuine parking notice:

Real Parking fines will include the vehicle registration

Real Parking fines will show the time/date of the offence

Real Parking fines will show the Location where the alleged offence took place

A genuine fine will always come in writing and will be left on your windscreen, handed to you in person or arrive in the post. There are three types of fines you may receive:

A penalty charge notice issued by the council

A fixed penalty notice issued by the police usually linked to offences such as speeding

A parking charge notice issued by a private company

What to do - and not do

If you have received a text message or email that doesn’t feel right, STOP! (This advice applies to all suspicious communications, not just potential parking scams.)

Break the contact: do not reply, do not click on any links, do not call any phone numbers, do not make any payments.

Check if it is genuine: contact the organisation directly using an email address or phone number you know is correct, e.g. from bills or official communications, via a search engine, on the back of your bank card, by calling 159 (see below)

Forward spam calls and texts messages to 7726 and emails to report@phishing.gov.uk.

Visit the StopThinkFraud website (website opens in new tab) for information on how to protect yourself from fraud. If you have lost money or provided financial information because of fraud, notify your bank immediately and report it to Report Fraud (website opens in new tab).

Skimming devices on parking machines

This is a new scam which targets people paying for parking at machines. Fraudsters attach a physical device to the contactless payment reader on a parking machine and when you try to pay, the machine displays a “card declined” message. You walk away to try another machine but the skimming device has already stolen your card details.

How to tell if a parking machine might have been tampered with

Check for extra stickers or other items on top of the contactless payment button

Check for correct logos and branding.

Trust your Instincts. If something looks or feels suspicious, don’t use the machine.

If in doubt, pay by cash or use a parking app on your smartphone.